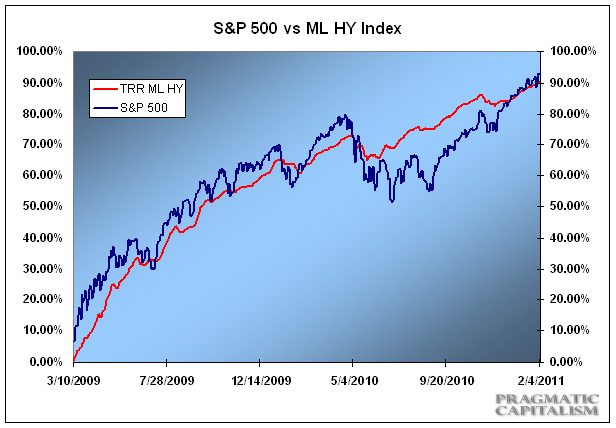

1) Is the high yield market now sending a warning? One of the most striking characteristics of the rally over the last two years has been the divergences between the high yield bond market and the S&P 500. During the early portion of the rally the high yield market lagged substantially. To me, it was one of many signs that said credit markets were still the more attractive value, however, as the rally progressed the HY market matched the performance of equities. The divergence became apparent again following the flash crash when HY bonds failed to match the fear that equity markets were displaying. In recent months equities have surged ahead for the first time since the rally began in March 2009. While there is little to feel bearish about right now I wonder if this isn’t a sign that a more cautious stance on the markets isn’t warranted?

2) Bring on the bubbles. This market feels more and more like it has all the ingredients to get very bubbly in the coming years. A bubble needs three criteria in order to form:

- Fundamental factors that generate a rational market response.

- A trigger mechanism that transforms a rational market into an irrational market.

- The psychological acceptance of irrational pricing that distorts fundamentals from reality.

The combination of good profit growth, decent economic growth, surging commodities, the Bernanke put and the acceptance that the Fed will not allow equity price declines have all come together to create a perfect environment for irrational exuberance to become pronounced. If the Fed has it their way we could easily surpass Goldman’s 1500 target on the S&P before they are even done with QE2. And who knows where commodity prices will be at that stage….

3) Capitalism without losers. Just how damaging is a world without losers? Yesterday’s consumer credit data made it pretty clear that the consumer is starting to re-leverage. This is extremely positive for economic growth in the near-term, however, it is alarming in the long-term. Consumers haven’t actually straightened out their balance sheets, but why should they? No one loses in this market. There are no repercussions for excessive debt and out of control spending. So the lesson to consumers is obvious – you don’t need to be prudent. You don’t need to save. You need to borrow. You need to leverage yourself up. After all, you are American. You have a right to own an Ipad, a flat screen TV, a luxury automobile, a McMansion and all of the other things that are not privileges, but our rights as Americans. And we know this is true because it is what the government promotes via their endless “no losers” capitalism policy.

This government’s policies are directly tied around the idea of getting credit going again. After all, it is the core of the theories that have driven economic policy for decades now. For the last 30 years we have focused on building a banking behemoth that specializes in bankrupting its clientele. We have de-regulated the banking sector to the point where they have a virtual monopoly on the US economy and without them we think we can no longer survive. We are so dependent on credit growth that we have all mortgaged our futures away just to keep this economy afloat and the music playing for one more decade.

We reward those who buy homes when they are overvalued. We encourage speculation in markets when the fundamentals aren’t there to support them. We pay people for sitting at home and doing nothing. We bailout companies that made bad bets. We reward people for buying cars they can’t afford. And worst of all, we don’t even prosecute the people who helped cause the recent credit crisis. Oh, capitalism without losers.

The scariest part of this is my own mentality. I find my mind wandering sometimes thinking about what it would be like to be totally reckless with my spending. Oh the things I could buy if I just leveraged myself to the hilt. I could really help get this economy going again. Add a little velocity to the money supply while crippling my own balance sheet and helping a bank to pad its own capital base just in case it decides to pay its executives a little extra this year. That’s what they want after all, right? Sadly, I am an outlier in the world of credit. I have been one of those prudent savers who now feels punished. But here I am learning that prudence is for losers. And if a pragmatist like myself is having these thoughts then what sort of thoughts are the irrational having? And where will this take us? Surely, it can’t be good. We are promoting a reckless approach to savings and investment. It feels great for now much like it did during the earlier portion of this decade, but I fear for its repercussions and how this damaging psychological approach to markets will ultimately play out. I fear we will look back at some point in the not so distant future and wonder why we allowed this to happen to ourselves and why we continue to push theories and economic strategy that failed us long ago….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.