4 Things Worth Reading:

- Goldman: why stocks could continue to decline – Joe Weisenthal

- The Most Expensive Stock Markets in the World – John Mauldin

1 Economic Summary:

- No data today, but the Fed statement did provide some economic guidance/perspective/fireworks. As expected, the Fed announced a further $10B in tapering to $65B per month. There was no mention of the emerging market issues. I likened this to a bike with training wheels where the parents are slowly letting go of the bike. The training wheels are still on (the Fed is still purchasing assets), but it doesn’t quite feel comfortable just yet so we might see the markets engage in some temper tantrums. Still, I wouldn’t equate $65B in purchases to tightening. Especially when we consider that ZIRP is here to stay.

1 Pretty Picture:

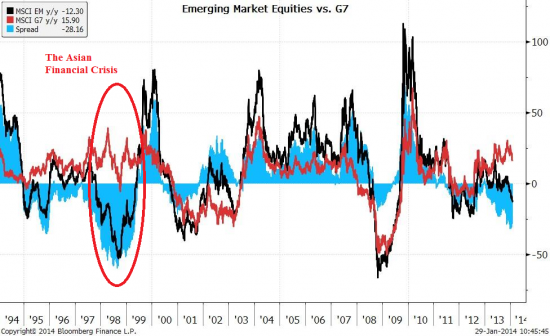

- If we are indeed on the precipice of a 1997 style currency crisis then the past may provide some guidance to future asset price risks. During the 1997 crisis emerging market equities substantially underperformed the G7 and more developed countries.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.