The economic recovery is becoming broadly accepted and potentially priced into the markets. The recent string of upside surprises in earnings reports and economic data show that the investment community has largely unappreciated the strength of the recovery. But as the analyst community raises the bar the expectations for continued growth will become increasingly difficult to overcome.

While the days of 60+ ISM readings, record margins, and persistent earnings beats seem to have become the norm, the truth is that many of these indicators are highly cyclical by nature and/or mean reverting. It’s not unusual for the investment cycle to peak at a time when expectations are high and this cyclicality begins to bite.

Recent data shows a few signs of at least a near-term blow-off in expectations. This doesn’t mean the bull market is necessarily over, but it does present a sizable challenge for markets going forward. Remember, market direction is not just the sum of the opinions of its participants. Market direction is the sum of those opinions when compared to expectations. The market does not care whether you think the FOMC will raise rates today. You could very well end up being right and the market could still move against you as the opinions of the other participants are already priced into shares and broadly expected in advance.

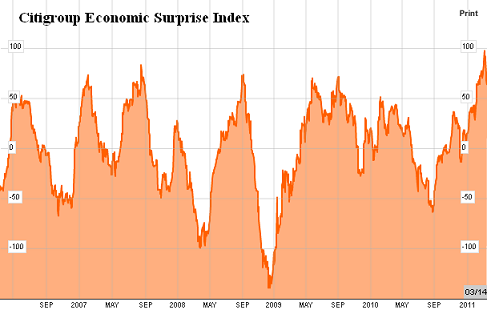

There are several indicators that compare reality to expectations and give a real-time perception of this phenomenon. I highlighted the Citi Economic Surprise Index last month. This index shows the weighted historical standard deviations of data surprises comprised by the analyst community compared to the Bloomberg median estimates. It has been flashing a warning sign for several weeks now and although it has come off its highs the index remains at a historically elevated level.

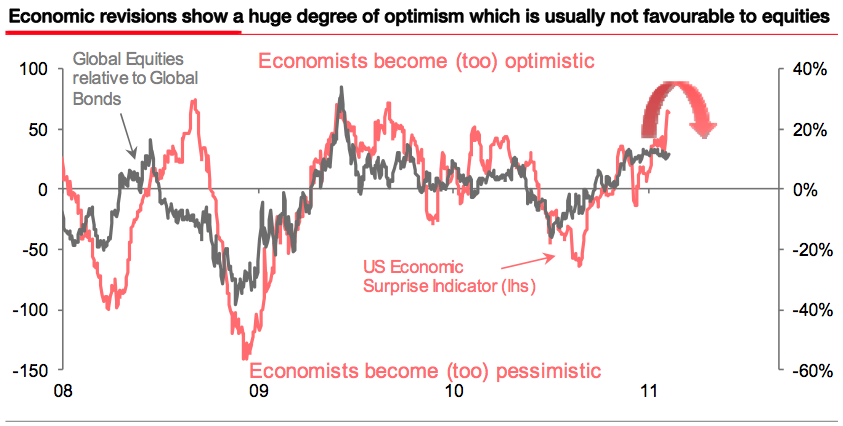

A few weeks ago Barry Ritholtz highlighted a similar phenomenon noted by SocGen analysts:

“After undergoing a massive rally since last September, risky assets are now technically vulnerable: SG Quant sentiment indicator is close to an all-time high, economic revisions have rarely such a high percentage of upgrades, equity volatility is at a four-year low, the Canadian dollar is dear versus the USD and lastly inflows into equities reached $8bn last month, led by “panic-buying.””

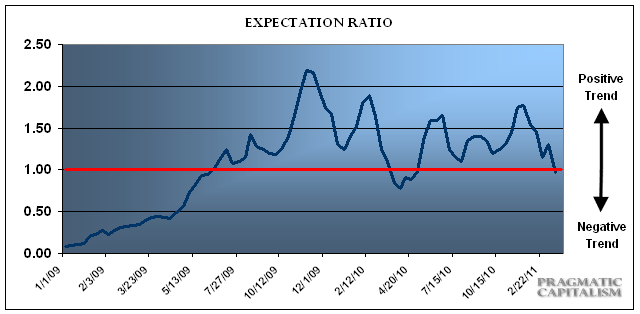

My Expectation Ratio, which measures the strength of future earnings growth compared to analyst expectations turned negative (sub 1.0) on February 28th. This is the first time the index has turned negative since March 12th of 2010. This is generally consistent with an environment in which strong earnings and robust corporate balance sheets are broadly expected and priced into shares. While the current reading of 0.97 is by no means an extreme negative it could prove to be a risk in the current earnings season if we see further deterioration. Over the course of the majority of the rally from the 666 lows the ER has remained firmly in positive (1+) territory except for a brief period preceding the flash crash. A sustained downtrend in the index would likely precede a far more challenging earnings environment.

None of this points to impending doom and gloom in the markets, but as expectations rise in the near-term these indicators create barriers that the market could have difficulty overcoming. The recent oil scare and the crisis in Japan could be enough to temper sentiment and bring expectations back down to earth. That process, however, could take some time and involve continued downside risk in equities as these high expectations are cleared and fear breeds opportunity for upside.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.