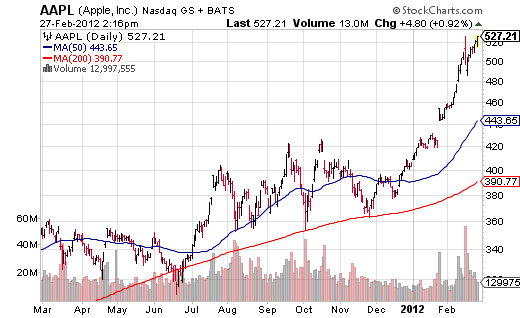

A few weeks ago I asked a simple question – “would you buy this stock”? The point of the exercise was to get readers to begin thinking about the ways that a simple chart can tell a story about the market’s current state. As many of you guessed, the stock is Apple. I’ve attached an updated chart below.

Chartists often catch a lot of flak for being excessively simple and ignorant of market moving factors. But charts can offer unique perspective. Particularly when the market is behaving in an extreme fashion. I like to think of charts as an image of the fundamentals. In a sense, charting is just another form of fundamental analysis. But charts can also tell a story about behavioral finance.

The way I think about this chart of Apple is as follows – the fundamentals for the company are tremendous. Price targets are on the rise, estimates are being bumped higher every day, and the general outlook for the company looks like a can’t lose situation. So what happens when this becomes the common perception in the market? Everyone wants in on the action. And when everyone wants in on the action they will be willing to buy at whatever price they have to. It doesn’t matter because they think the price is going higher. But what’s really happening here is the market price is being compressed. Apple investors are taking a long-term perspective and compressing it into a buying frenzy. So many quarters of performance get priced into a very brief window of market activity. It’s a classic case of recency bias at work in real-time. Investors extrapolate recent performance out into the future and in this case take many quarters and compress them into one. This isn’t problematic so long as no problems arise. But the market is cyclical even in the near-term. And these compressions often result in an eventual decompression when something changes the fundamental outlook. And when the market decompresses that’s when the ponzi effect reverses and everyone wants their money back.

Now, I am not saying that this will necessarily happen with Apple. But what we’re seeing is a classic case of price compression. And what this does is elevate the risks tremendously because the risk of decompression rises as the compression becomes even more extreme. As Minsky would have said, “stability creates instability”. The point is not to say that Apple is going to crash or even decline substantially. But understanding this dynamic can keep an investor out of substantial trouble. Understanding the risks and weighing those risks compared to the thousands of other investment options can help you avoid a lot of pitfalls along the way to the top of the investment mountain. I know it has for me….

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.

Comments are closed.