WARNING: This post is only for high level nerds. If you don’t have the proper clearance you are susceptible to extreme sleepiness in the next few minutes.

Eddy Elfenbein has a great post up on the recent state of dividends in the USA. He says:

“Dividends for Q3 were $10.02 per share which is an increase of 12.50% over last year’s Q3. Note that over the same time, the index has increased its price by 17.29%. So in terms of dividend yield, the S&P 500 has a slightly higher valuation but both dividends and stock prices are growing roughly inline with each other. That’s why I think much of this “bubble” talk is very premature.”

He goes on to show how dividends and the S&P 500 have tended to correlate to some degree. Now, this is a bit counterintuitive, but if you understand the profits equation then you know that dividends play a big role in driving corporate profits. And since profits are the key fundamental driver in stock prices then, well, you do the math.

What’s interesting and counterintuitive in all of this is the idea that dividends are a major driver of corporate profits. After all, if a company pays me a dividend then that should reduce their profits, right? Not at all! Here’s why. Corporations don’t count dividends as a business expense because they’re distributed profits. And if households spend all of this dividend income (ie, don’t increase their saving) then this contributes to corporate profits. So, if the household saving rate remains the same then that means that increased dividends are actually ADDING to corporate profits over time (as has been the case in recent decades).

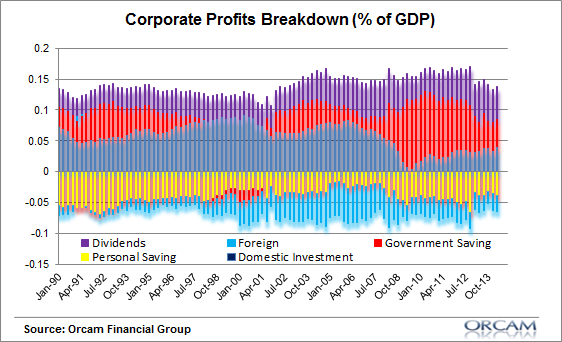

We can see this visually by breaking down the components of corporate profits. It’s no coincidence that household saving is declining, dividends are rising AND profits have remained strong:

I always like to emphasize the importance of accounting in finance and economics. Whether it’s understanding the Flow of Funds, the Sectoral Balances, saving/investment or even just basic profit drivers. Accounting is the language of finance and economics. So, if you’re still awake then congratulations. You’re a little bit nerdier than you were 5 minutes ago.

Mr. Roche is the Founder and Chief Investment Officer of Discipline Funds.Discipline Funds is a low fee financial advisory firm with a focus on helping people be more disciplined with their finances.

He is also the author of Pragmatic Capitalism: What Every Investor Needs to Understand About Money and Finance, Understanding the Modern Monetary System and Understanding Modern Portfolio Construction.